How to Successfully Realize Lower Costs and Increased Sales?

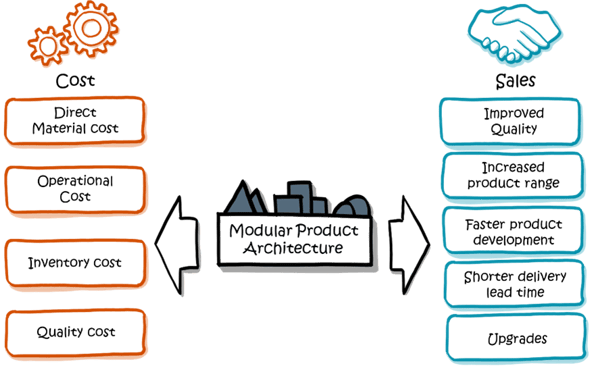

The target with modularization is to meet three business objectives: Operational Excellence, Customer Intimacy and Product Leadership. When you achieve these objectives, you will see a positive impact both on the sales side of the P&L and on the cost side.

To succeed with modularization also means change. The conversion to a modular product architecture is a transformation process for a company. The challenge is to adapt product architecture as a long-term management strategy, ramping up the financial advantages of modularity over time.

To mobilize the necessary support from all areas of the company and at all hierarchical levels, the advantages of the modularization strategy must first be quantified and brought into line with the business goals. The collected data should be structured in a business case, giving a complete overview of the potential to lower cost and increase sales.

In this blog we will give you some insights in how to calculate the effect of complexity cost reductions, to assess the impact on direct material and direct labor and to look at revenue growth enabled by modularity and configurability.

Strategic Goals as the Basis for Modularization

But, before we go into the details of the financial impact, let us touch on one of the key success factors, namely the strategic anchoring of the development program.

Modular product architectures are often developed from a purely technical point of view. Even though these product architectures are surely developed with great effort, they typically fail to achieve the desired effect when they do not reflect the company strategy, or the true market need.

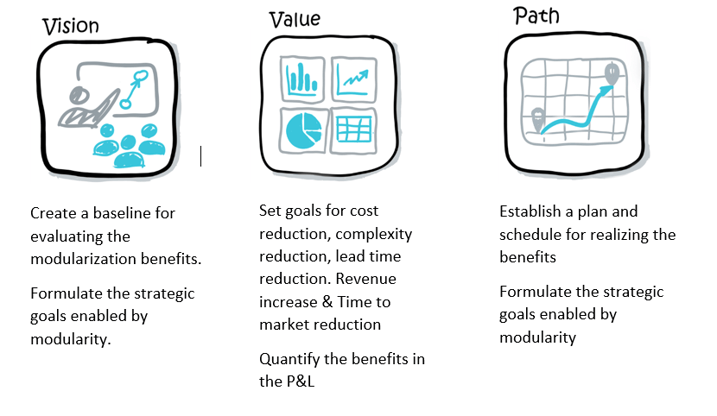

When you embark on a journey to improve your level of modularity, you need to anchor the vision and targets and align the management team. You do this by creating a shared vision, an understanding of the value and an agreed path forward.

The rest of this blog post will take a closer look at the Value and how to work out the financial impact of the modularization strategy.

Many people say that a reliable calculation of the financial effects of a modular product architecture is not possible. That's not true. We will show you that it is possible to calculate the financial effects, and thus give you a sound financial basis for your development decisions.

How Variant Reduction Reduces Cost

To estimate the potential to reduce complexity costs, you must first determine to what extent the complexity can be reduced.

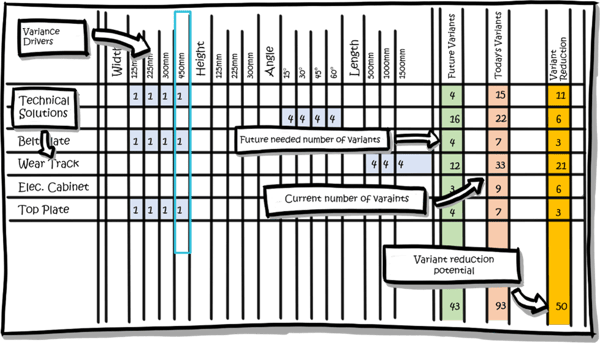

This is done through an assortment analysis that determines the reduction potential of unnecessary variants of technical solutions and part numbers.

For each technical solution, you analyze if it is influenced by the product variant-drivers. If so, the next step is to quantify how many variants of the technical solution will be needed to fulfill the requirements of variance for the modular product architecture.

In parallel with this analysis, the current technical solutions are also counted. Comparing the number of existing technical solutions with the real need for different technical solutions driven by variance need, gives us the reduction potential for the technical solutions.

The graphic shows the comparison of required and existing technical variance in a simplified matrix.

There are varying reasons for currently having an excessive variance, but a common one is that the current product range is made up from many different products/platforms. By combining them into one modular product architecture, the unnecessary overlaps can be eliminated.

Reducing Complexity Costs

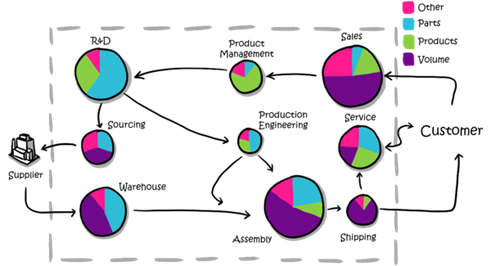

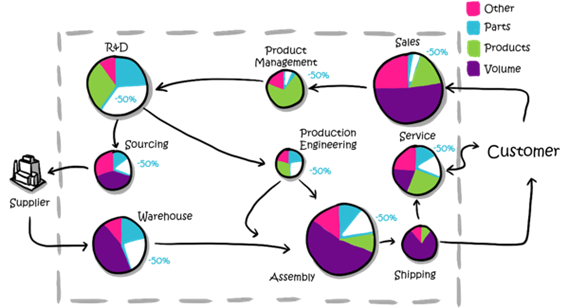

Before the reduction in complexity can be translated to the reduction of costs, the proportion of complexity costs in the total operating spend must be determined. To do this, all company functions are analyzed to find what specific activities are driven by complexity, i.e. number of unique part numbers. The result can be illustrated in the following value map:

Almost all cost centers include activities driven by complexity. For example creating CAD models and product development in R&D. Other activities depend on the variety of products on offer. This applies, for example, to marketing activities for individual product variants. Part handling activities in parts reception, warehouse and production change in line with the volume of parts and products. Finally, there are also activities whose scope does not scale directly with the complexity of the products.

By combining the findings in the complexity analysis of activities per function with the previously made assessment of the complexity reduction potential, the savings potential from complexity costs reduction is determined

An example: if the number of different variants of a technical solution is reduced by 50 percent, which is a realistic value for modularization programs, then a large share of the activities in the individual cost centers and the corresponding costs can be freed up for more productive work. The picture below illustrates this.

For project driven business, the potential to reduce complexity costs can be determined using a similar analysis. Instead of counting the number of technical solutions, you can analyze the configurability of today’s product offering compared to a future modular product architecture, identifying the complexity reduction potential. This analysis focuses on project lead time and cost for associated personnel, rather than the cost centers for different business divisions.

Reduce Direct Costs Through Economies of Scale

The direct costs in purchasing and production can also be reduced considerably. Here we are talking about the economies of scale often mentioned in connection with modularization. To determine the potential effects, the previously performed complexity reduction calculation is required again.

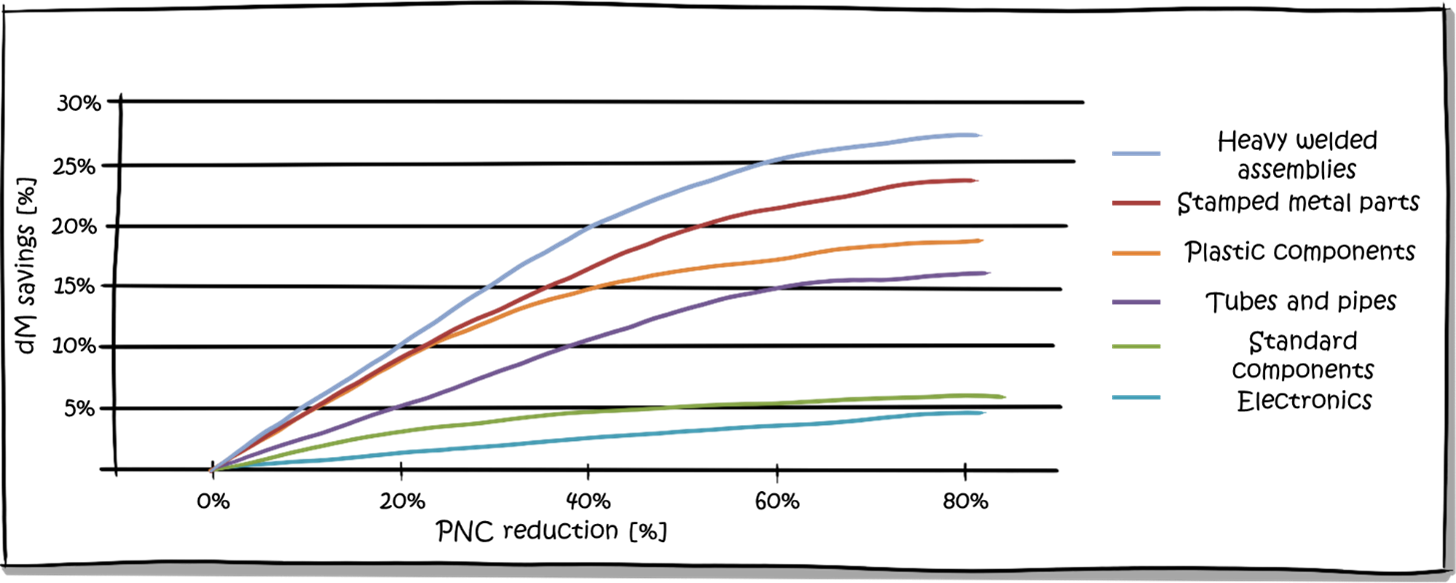

We know the potential for reducing part numbers for the individual technical solutions, also known as Part Number Count (PNC) Reduction. The effects of PNC Reduction on the savings in direct material costs (dM savings) depend on the type of product, but the principles are common. By reducing the variance in purchased components, the company can buy a larger volume of the remaining components and can reduce purchase price through economies of scale at the supplier or in manufacturing. Another way to achieve cost savings is to reduce the variants of manufactured pressed parts and hence reduce the need for different variants of cost-intensive manufacturing tools.

The graphic below shows an illustration of how much direct material costs can be reduced - depending on the PNC Reduction for different types of components. The graph is based on experience data and the exact numbers for your company will depend on your situation.

Further Potential in Development and Production

In addition to the impact from complexity costs and direct material costs, a modular and configurable product architecture opens a multitude of other options for reducing costs, especially in development and production.

The knowledge of the variant drivers and the required variance makes it possible to design for minimizing over-specification. The configurability created by modularization initiates new opportunities to optimize production, including late product differentiation, more pre-assembly and faster throughput times.

What you want to achieve is the optimum balance between providing variance to your customers while optimizing your design and production processes. Find out more about this in our blog article on Simplicity + Variety = Product Portfolio Success.

Not only Lower Costs, but also Additional Sales

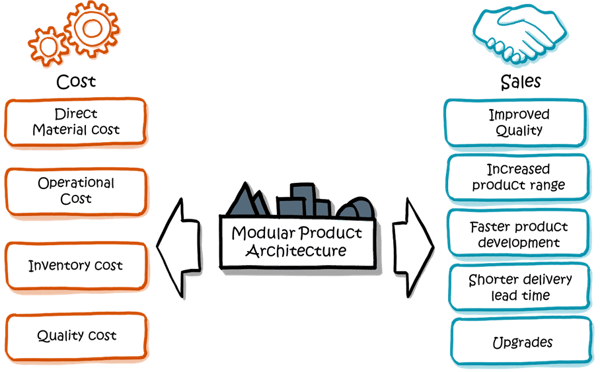

The overall objective with modularization is to reach the strategic business goals. These were previously discussed in the dimensions of Operational Excellence, Customer Intimacy and Product Leadership.

By reducing operational costs as well as cost for direct material, goals in the dimension of Operational Excellence are met.

In the dimensions of Customer Intimacy, the configurability of the products makes it easier to offer product variants that exactly match the needs and preferences of your customer. Upgrades and updates can be incorporated into the products more easily and the delivery lead time can be reduced.

Product Leadership can be maintained or improved through faster innovations, reduced time-to-market for new products. These effects are often substantial and can support you in generating additional sales.

Consequently, the financial effects of the modular product architecture consist of both cost savings and increased sales.

The sales growth also depends on other factors that are beyond the direct control of a company, making the benefits related to these more uncertain, but they should still be considered as input to the business case. The cost side is more predictable, and a modularization project normally pays off based on the internal cost savings alone.

In this blog, we intended to show you some of the most important steps in how the financial effects of a modular system can be calculated. It should be noted, however, that further calculation steps are necessary to capture the full financial savings potential of your future modular product architecture.

Cost Reduction + Sales Growth = Support for Your Modularization Strategy

Knowing the financial levers of your modularization strategy is an important prerequisite for its implementation. This knowledge also has a decisive influence on the creation of modular product architecture. As this is a transformation journey for the whole company, a coherent business case is necessary to secure that the program receives adequate support and priority.

When you analyze your company’s financial impact from modularity, you should consider the following parameters:

- Estimated reduction potential of technical solutions

- Quantified complexity cost reduction

- Calculated reduction of direct material costs

- Estimated financial effects through modularity and configurability

- Quantified sales growth from an improved modular product

- Strategic input needed to later create the modular product architecture

Do you want to find out what financial potential a modular system offers for your company, read more about our Modular Strategy and Potential here. Or view our webinar on how to reach a positive financial impact through a Modular Product Architecture. Do not hesitate to get in touch with us for a discussion based on your unique situation.