Cost of complexity is a term often used to describe the costs that are caused by introducing new product platforms and products, as well as managing the variety of products produced. Many different products would cause a high cost of complexity, fewer and more similar products a low cost of complexity. In essence, it is a way to understand the economy of scale and how products affect it.

Cost of complexity is hidden in many different expenses that you would find in your income statement. It exists in direct costs such as material and labor and indirect costs such as R&D, sales, procurement, and production planning. Companies that are interested in cost of complexity often talk about Part Number Count, or PNC, and how to understand the cost of introducing a part number and the cost for maintaining a part number.

Understanding the cost of complexity is key to enable balanced decisions regarding your product architecture and modularization. To balance re-use and economy of scale to optimized designs and supply chains. One such decision is to prune the product portfolio by phasing-out products that can't carry their cost of complexity.

In this blog post I will explain a bit more what cost of complexity is, and how you can analyze it. Also, feel free to download an Excel template helping you with your analysis!

How to Allocate Overhead Cost when your Company Sells many different Products

Robert S. Kaplan and Robin Cooper who are often credited as being the inventors of activity-based (ABC) costing say that a company needs a cost system to perform three primary functions (Cost & Effect: Using Integrated Cost Systems to Drive Profitability and Performance, 1997):

- Valuation of inventory and measurement of the cost of goods sold for financial reporting

- Estimation of the costs of activities, products, services, and customers; and

- Providing economic feedback to managers and operators about process efficiency

The first one is driven by entities external to the organization, e.g. investors and tax authorities. The procedures for the external reporting are governed by a myriad of rules. The second and the third function are driven by internal needs.

Historically and still today many companies try to fulfill all three needs with a single costing system. In an environment of limited product and process variety this may have sufficed. However, as very few businesses have a limited variety today this is clearly no longer possible. Traditional, simplistic, costing systems allocating overhead costs based on direct costs are still fine for financial reporting. Auditors, tax authorities, etc. are fine with overhead rates that reach 1 000 % of direct labor costs for e.g. machining or robot welding. Auditors are often more concerned with year-to-year method consistency than the costing accuracy.

However, these traditional methods give poor information for management decisions about what products to sell, how a product should be designed, which supplier to select, etc. Worst case, they may tilt the board so that the wrong decisions are made.

Since many researchers today believe that 80 % of the manufacturing costs are determined during the product design and development stages there is a clear need for a system with less distortions. At least to give input to sound market, sales, and development decisions.

Standard Costing

The scientific management movement led to standard cost systems that have been the foundation for companies’ cost control systems for most of the twentieth century. Different systems have evolved but they have the same basics. Responsibility/Cost centers are the focal point of cost planning, cost control, and product costing. This enables the managers to control the efficiency of the cost centers (at least in theory…).

Cost centers are typically divided into direct and indirect (supporting). A distinction is also made between variable and fixed cost for all cost centers, and annually financial managers plan for each cost center’s expenses for the coming fiscal year (annual budgeting).

Example

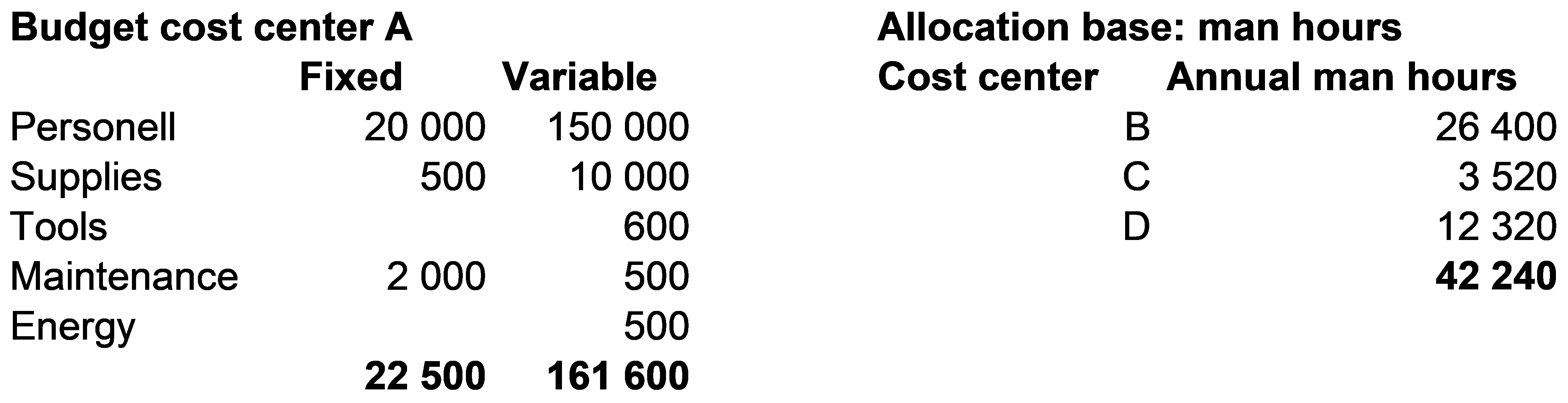

- An indirect cost center for quality inspections (A) is supporting three different direct assembly cost centers (B, C, and D).

- A’s budget is divided into fixed and variable and allocated to B, C, and D based on their number of assembly hours (man time).

A’s fixed costs would be distributed to B, C, and D according to their planned man hours. B, C, and D would also need to add an overhead cost of 161 600 / 42 240 = 3,83 to every man hour. This cost would then be assigned to the products based on assembly time.

Activity Based Costing – a Tool that can Calculate the Cost of Complexity

As you understand standard costing is straightforward for a cost center that is close to the production such as quality control. However, for other cost centers, such as R&D, it is much harder to select an allocation base that does not distort the results. Standard costing also has an inherent flaw in that it relies solely on unit level cost drivers such as labor hours, machine hours, units produced etc. It can’t accurately cost activities that are made for a batch, a part number, a product etc. This leads us to an example which can be used as a reason for activity-based costing.

The Shoe Factory

Think about a Shoe production business, SHOE Inc. They manufacture sandals and slippers of different varieties and sizes. They produce about 5,000 SKUs every year in volumes ranging from only 50 to 10,000 pairs. In total the production volume is 1,000,000 pairs every year.

The shoes are not very expensive to produce. They are made mostly out of cotton and rubber which is cheap and readily available, and the production process is automated to a large extent. However, significant work goes into handling all the SKUs: Machine scheduling, machine setups, inspections after setups, material management, product design, production preparation, etc. The vast number of SKUs also pushes up inventory levels both in the material warehouse and the finished goods inventory to reduce the order to delivery lead time. Since it is hard to exactly forecast the demand, there is also periods of idle time, and other periods with increased labor cost due to overtime for short term capacity increase.

Now, think about two specific SKUs.

The first one, call it Complex SKU, is a customer specific cotton slipper for a small business giving them as Christmas presents to employees. It is produced in only 50 units. But still, SHOE designers must adapt the logotype to the right format, try the production out, and communicate with the customer. The setup of the machine for the production run takes away almost one hour of production time. The logo requires a specific thread color which is not in SHOEs standard assortment and must be ordered separately.

The second one, call it Simple SKU, is a standard white cotton slipper, sold to hotels, gyms, and spas worldwide. This single SKU has not been redesigned for 25 years and is being produced in 10,000 pairs every year.

The total overhead cost of SHOE is 8 million dollars. The total direct production cost (material and labor) is 4 million dollars. In total the cost is 12 million dollars. If we used standard costing, we might end up with each produced pair costing roughly 12 dollars (if we assume similar material and labor costs for all SKUs). But is this really fair? The 50 pairs of complex SKU, actually drives more overhead than the 10,000 pairs of simple SKU?

Once we calculate a bit more, we see that a pair of Complex SKU is about $5 more costly to produce. This is something to consider when deciding if this is a profitable order or not, and how to price custom products.

Both shoes are similar in quality and style, so they roughly have the same material costs (there aren’t much volume effects in bulk materials such as textile and rubber soles once you reach a certain volume). Both also need about the same number of direct labor hours for manufacturing. The only cost difference is that Complex has much higher indirect costs for supporting the operation.

No matter how many cost centers we use to track the different indirect cost, we will have a hard time to distribute high overhead costs with sufficient accuracy if we only have unit level keys for distribution (e.g. volume, machine hours, material cost, labor hours, etc.)

The low-volume customized shoes drive much more indirect resources per produced shoe – design, setups, etc. For companies with a diverse product mix, standard cost systems will significantly over-cost simple high-volume products and under-cost complex low-volume products – no matter how many cost centers they use.

Calculating the Cost of Complexity – is it Worth the Effort?

Activity based costing aims to solve the limitations of standard cost systems by adding cost drivers that are not on unit level. Examples might be batch-driven activities, activities driven by product platforms, products, part numbers, etc. and the introduction of these entities. Activities might be driven by customers or sales channel from the market side, or by suppliers from the supply side.

Activity-based costing (ABC) is often criticized for being very expensive to implement, much more expensive than the benefits of the information. However, if we forget the first reason for having a costing system (external), the need of details is much, much lower. By doing ABC without striving for perfection, we get results that are good enough to make decisions upon. Much better than the information that we have from standard costing. There is no need for expensive time studies and such to link resources to activities. Approximations and qualified estimates are good enough to get rules of thumb for design decisions. An often-quoted phrase is that the goal is to be approximately right instead of exactly wrong.

How to Analyze Cost of Complexity?

So, how should we apply ABC to calculate Cost of Complexity? Here’s the main steps to get to a result good enough to support your decisions related to product planning and development:

- Analyze the cost of each department

- Analyze what activities that are performed, and how much of the resources that are spent on them

- Analyze what the driver is for each activity

In the end you will get an approximation of the cost for the different cost drivers, that can be compared to the amount of the same drivers. This lets you find KPIs or rules of thumb, such as the cost of a part number, that you can use for design decisions. It also gives visibility to where in the company these costs are incurred.

Download this excel template to analyze Cost of Complexity for your business.

Want to know more?

Please contact us directly if you'd like to discuss the topic covered in this blog or looking for a sounding board in general around Modularity and Strategic Product Architectures.